Pip refers to point in percentage. It refers to change in the measurement of currency in a very small quantity in the forex market. Pip can be measured in two forms that include quote and underlying currency. A currency quote sometimes change in very little amount which can never be smaller than a pip. Pip is the smallest amount of change that can occur in a currency.

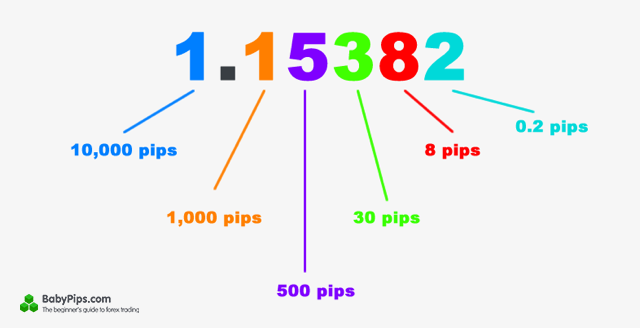

Image source: Babypips

Pip is a standardised unit and is generally 1/100th of 1 %. It can also be expressed as $ 0.0001 for U.S. Dollar related currency pairs. This helps the investors to overcome huge losses as pips are the most fundamental unit of measurement.

It is usually the last digit especially the last decimal place of a price of underlying currency.

it is a basic concept of foreign exchange market known as forex market. Generally, quotes are exchanged with the help of bids and quotes are asked up to four decimal places in the forex market with the help of forex pairs. Also, traders like to buy or sell only those currencies which can be expressed in terms of other currencies.

Change in exchange rate of the currency is expressed by pips. Since most of the currency pairs are expressed up to four decimal places hence, 1 pip refers to the smallest change in these currencies.

It is generally the last decimal place of any quote of the currency. It usually refers to one basis point. One basis point means a common unit to measure interest rates and their financial percentages.

Pips and Profitability

At the end of the day, traders can know whether they have made any profit or loss from their positions. This is possible only with the help of pips as the movement of any currency pair determines the profit and loss of any trader. For instance, a trader who have euro will get profit if the value of euro will increase in relation to US dollar.

Pip helps the traders to understand their trading strategy and enter into trades. It also helps them to edit orders and manage their strategies related to trading. They usually take the help of pips to calculate their profits and losses.

Determining the value of Pip

There are three factors on which the value of pip depends. These factors include the size of the trade, the currency pair being traded and the exchange rates of the currencies. Change in value of pips depends highly on these factors. Any change in the single pip also has huge impact on value of the position of traders.

Major currencies Pips

Pips values vary according to the change in the values of the currencies. This is because pips values are highly dependent on how the currency is being traded in the market. Sometimes, it becomes possible to even measure to price move in half pip increment.Hence it depends on trading platform and the price feeds.

The major currencies that are traded by investors include yen, us dollar, euro, Canadian dollar and the great British pound. These major currencies can be paired with each other.